Financial Protection

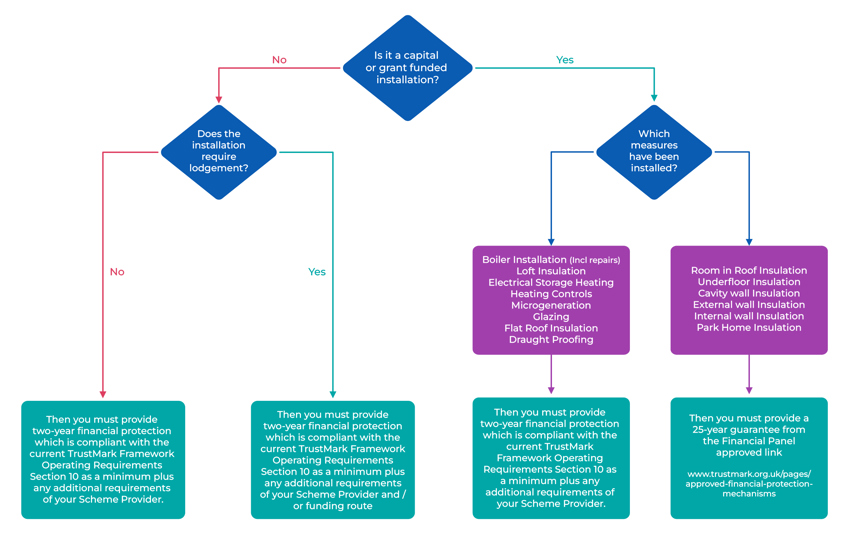

TrustMark Registered Businesses are expected to provide their customers with the appropriate level of financial protection

To comply with the TrustMark Framework Operating Requirements all Registered Businesses are expected to provide a minimum of two-years financial protection for completed works carried out in and around your home covering product warranties and workmanship.

You can also protect your investment with TrustMark's low-cost escrow service.

Many Registered Businesses will have the ability to offer you a more comprehensive financial protection cover, but it is important that you obtain details from the Registered Business of the cover that they offer before contracting with them to avoid any misunderstanding at a later stage.

The aim of the financial protection mechanism is to cover you against certain risks if the business were to cease trading for any reason. The protection on offer may vary slightly from business to business, depending on their financial protection provider – but whichever financial protection mechanism is on offer, TrustMark expects Registered Businesses to have coverage for the following:

- Prepayments (Such as deposits or otherwise in advance of work being undertaken)

- 2-Year Post Completion of Workmanship

- Rectification of defects and/or Non-compliance with Building Regulations

- Major damage or injury (through public liability insurance)

Before contracting with a Registered Business, you should make enquiries of the Registered Business and/or their financial protection provider to satisfy yourself that the protection they offer covers the specific products and/or systems you are having installed.

It is the responsibility of the ECO supply chain to determine whether a product/system is suitable and to ensure that it meets all relevant ECO requirements, in addition to any set out in the TrustMark approved guarantees; because a measure is eligible for a guarantee it does not automatically mean that it is ECO eligible.